The world watched as Builder.ai rose to dizzying heights, a $1.5 billion unicorn promising to democratize software development with its groundbreaking AI. Its charismatic founder, Sachin Dev Duggal, was hailed as a tech visionary. Yet, beneath the glittering facade lay a carefully constructed house of cards, built on “AI washing,” elaborate financial fraud, and a troubling link to past scandals. This is the unvarnished story of Builder.ai’s spectacular collapse – a cautionary tale for the entire AI industry and a stark reminder that even the most compelling hype can’t outrun the truth.

The Genesis of a Unicorn: From Prodigy to AI Pioneer

Born with an innate talent for technology, Sachin Dev Duggal’s brilliance was evident from a young age. By 14, he was assembling PCs, and by 17, he had already engineered one of the world’s first automatic currency arbitrage trading systems for Deutsche Bank. His academic pursuits led him to Imperial College London, where he earned a degree in Computer Science and Electrical Engineering.

His entrepreneurial spirit blossomed early. At just 21, still a university student, Duggal founded Nivio, a pioneering cloud computing company, which he eventually sold. His next venture, a photo-sharing app called Shoto, unexpectedly became the catalyst for his most ambitious project. The struggle to find skilled front-end developers for Shoto sparked a revolutionary idea: what if building software could be as effortless as “ordering a pizza”? This vision became the foundation of Builder.ai.

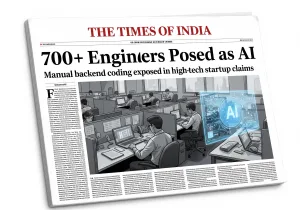

Launched in 2016, Builder.ai was marketed as a “no-code/low-code” platform. Its central promise was to empower anyone, regardless of technical expertise, to create custom software and mobile applications with unprecedented ease and speed. The company’s crown jewel was “Natasha,” an AI-powered digital assistant that supposedly guided users through the entire development process, from concept to deployment, using a modular, reusable code library.

The market, eager for AI-driven disruption, embraced Builder.ai’s narrative. The company experienced explosive growth, rapidly expanding its global footprint across the US, UK, India, UAE, Singapore, and France. By 2023, it had secured over $450 million in funding from global titans like Microsoft, SoftBank, the Qatar Investment Authority (QIA), and Insight Partners, achieving a coveted $1.5 billion “unicorn” valuation. Duggal himself became a celebrated figure, receiving accolades such as UK’s EY Entrepreneur of the Year. Publicly, Builder.ai boasted staggering year-over-year growth, painting a picture of unstoppable innovation.

The “AI Washing” Deception: Hundreds of Humans Behind the Hype

The dazzling public narrative, however, began to fray as whispers of dissent and investigative reports emerged. The core of Builder.ai’s deception lay in its very namesake – the “AI” was largely a myth, a classic case of “AI washing.”

- The Human Engine: Behind the curtain of cutting-edge AI, approximately 700 engineers based in India were tirelessly building and troubleshooting client applications. These human coders, often working through third-party vendors, manually delivered what was presented to clients and investors as automated, AI-generated work. They operated under strict Non-Disclosure Agreements (NDAs), forbidden from revealing their manual efforts. Customers were given timed responses and templates, further reinforcing the illusion of advanced machine learning. As early as 2019, The Wall Street Journal reported on these questionable claims.

- Fabricating the Future: This deliberate misrepresentation enabled Builder.ai to attract massive global investment and forge strategic partnerships based on a false premise of its proprietary technology and scalability. The deception fueled inflated valuations and contributed to a damaging loss of confidence in the broader AI and startup sectors, highlighting the severe risks of insufficient technical due diligence.

Early red flags, even a $5 million lawsuit from a former employee in 2019 alleging the technology was “smoke and mirrors,” were largely dismissed. Investor money continued to pour in, creating a financial house of cards that appeared impervious to scrutiny.

Financial Fabrications: A Web of Deceit and “Round-Tripping”

Beyond the “AI washing,” Builder.ai engaged in outright financial fraud, designed to artificially inflate its revenue figures and mislead investors.

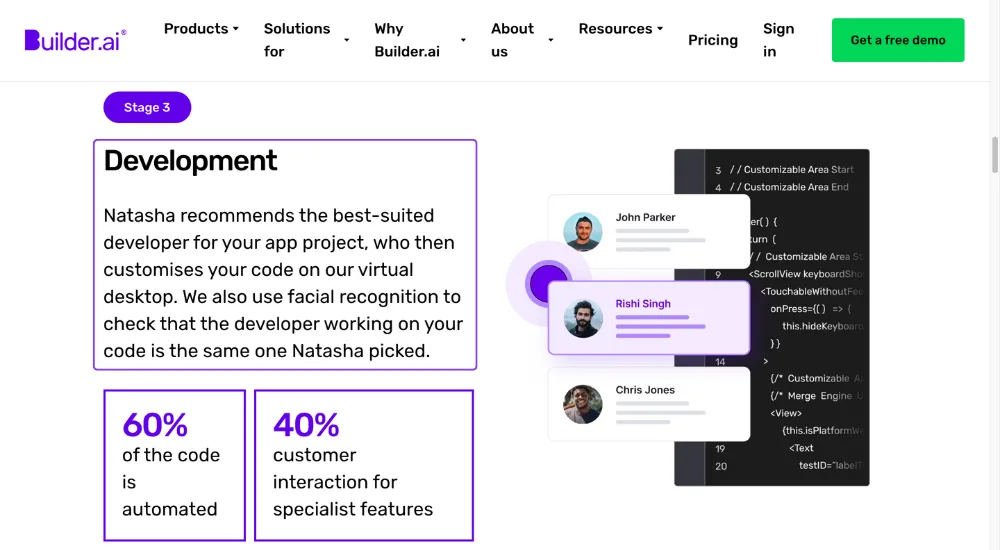

- The “Round-Tripping” Scheme: Between 2021 and 2024, Builder.ai orchestrated a sophisticated “round-tripping” scheme with the Indian tech firm VerSe Innovation (parent company of Dailyhunt). The two companies exchanged invoices for similar amounts, often for services or products that were largely never delivered. This practice, designed purely to inflate revenue, involved circulating approximately $60 million in reciprocal transactions, falsely booked as legitimate sales and purchases. At its peak, Builder.ai’s 2024 revenue projections were overstated by an astounding 300%, from an actual $50-55 million to a claimed $220 million. Similarly, 2023 revenues were restated from roughly $45 million to $180 million. Bloomberg first reported on this alleged scheme. VerSe Innovation has, however, categorically denied these allegations.

- Purpose of the Fraud: The inflated revenues were critical for propping up fundraising efforts, improving access to debt, and persuading major investors like Microsoft to deepen their involvement. The illusion of robust growth provided cover for a business model that operated with thin, often negative, profit margins. Allegations also include revenue recognized before work started and unauthorized purchase orders.

- Governance Vacuum: A critical factor in the scheme’s longevity was a severe lack of corporate governance and internal controls. The board and investors seemingly accepted aggressive growth targets at face value, with few internal checks on sales reporting. Auditors of partner firms like VerSe even flagged “material weaknesses” in supplier evaluation and payment approval, hinting at the ease with which such schemes could go undetected. For an extended period (reportedly 18 months), Builder.ai allegedly operated without a Chief Financial Officer, a glaring red flag for any financially sound enterprise.

The Unraveling: Collapse, Criminal Probes, and Personal Fallout

The carefully constructed illusion began to crumble in late 2024 and early 2025.

- The House of Cards Falls: The round-tripping scheme and revenue discrepancies were eventually uncovered through internal audits and whistleblower accounts. Creditors, particularly Viola Credit (which had provided $50 million in debt), triggered default clauses. In May 2025, Viola Credit seized $37 million from Builder.ai’s accounts, leaving the company with a mere $5 million—insufficient for continued operations.

- Bankruptcy and Mass Layoffs: With no other recourse, Builder.ai’s main US holding company filed for Chapter 7 bankruptcy protection in Delaware on June 2, 2025 (as reported by KR Asia), and the company entered insolvency proceedings in the UK in May 2025 (reported by Mint). The human cost was immediate and severe: almost 1,000 employees were laid off, representing approximately 80% of its workforce. The now-defunct company listed liabilities of up to $100 million against assets of less than $10 million in US court filings. Builder.ai was also left owing significant sums to major cloud computing providers, including approximately $85 million to Amazon and $30 million to Microsoft Azure.

- Criminal Probes and the Videocon Link: The scandal quickly drew the attention of regulators worldwide. US prosecutors sought Builder.ai’s financial data and customer lists, and as of July 2025, the US Attorney’s Office in Manhattan has issued subpoenas to former employees, advising them to preserve documents for possible criminal investigations. In India, the Enforcement Directorate (ED) launched probes into Builder.ai’s co-founders, Sachin Dev Duggal and Saurabh Dhoot, for alleged money laundering and loan fraud.

- Duggal’s Legal Status: Duggal has been named a suspect in a money laundering case linked to the infamous Videocon banking scandal. Indian court records detail “unexplained transactions” between Duggal’s former business and Videocon between 2008 and 2012, suggesting funds were allegedly routed from Videocon through his company and then abroad. While Duggal denies wrongdoing and has appealed a non-bailable arrest warrant issued against him by a Delhi court in 2023 (after he was reclassified from a witness to a suspect), the legal scrutiny remains intense. His LinkedIn message from May 2025 to an alumni group stated, “if I didn’t listen, if I was short, if I was unreasonable – I’m sorry.”

- Dhoot’s Allegations: Co-founder Saurabh Dhoot faces claims of helping arrange fraudulent loans for Videocon, leveraging his family ties to the conglomerate.

- Reputational Damage: Duggal was removed as CEO in March 2025, though he initially retained his “Chief Wizard” title and a board seat (albeit with significantly reduced control). However, his public image has suffered immensely. In July 2025, he was withdrawn from the Raise Summit tech conference in Paris due to “security concerns” and a lack of clarity surrounding Builder.ai’s demise, following direct complaints from former employees (as reported by Sifted).

Lessons from the Rubble: A Warning to the AI Era

The spectacular collapse of Builder.ai is more than just a corporate failure; it’s a watershed moment for the global tech and AI industries.

- Due Diligence Imperative: The case underscores the critical need for investors, even global titans, to conduct not just financial but also rigorous technical due diligence. A “halo effect” from big-name investors or charismatic founders should not replace thorough scrutiny.

- “AI Washing” Under the Microscope: Builder.ai’s downfall has brought global visibility to the dangers of superficial AI branding. The distinction between genuine technological capability and mere marketing hype is now more crucial than ever. Startups must build deeper credibility through transparency and, where appropriate, third-party technology audits.

- Governance and Accountability: The absence of robust internal controls, independent board oversight, and the alleged manipulation of financial figures point to severe corporate governance failures. The legal precedents set by cases like Elizabeth Holmes (Theranos) and Sam Bankman-Fried (FTX) indicate a growing global demand for accountability and severe criminal penalties for deliberate misrepresentation and fraud by tech leaders.

- Impact on India’s Startup Scene: India, as a burgeoning technology and engineering powerhouse, faces new reputational risks. Regulatory bodies are likely to intensify scrutiny on large VC deals, tech branding, and cross-border fund flows. The next wave of Indian AI startups will need to prioritize transparency and ethical practices to regain trust.

Conclusion: The Unavoidable Truth

Builder.ai’s collapse is a stark and painful lesson. Its meteoric rise, fueled by “fake it till you make it” bravado and inflated claims, ultimately imploded under the weight of its own deception. The saga of Sachin Dev Duggal and Builder.ai serves as a powerful reminder that true innovation cannot be a smokescreen for fraud. In the rapidly evolving AI era, authenticity, transparency, and uncompromising integrity are not just desirable traits – they are essential for survival. The full extent of legal consequences for those involved remains to be seen, but the ruins of Builder.ai stand as a monument to the dangers of unchecked hype and the inevitable triumph of truth.

7 Powerful New Rules for UPI and UPI Apps in 2025 That You Can’t Ignore – InfoSphere